This is a Singaporean’s ultimate nightmare. We even have a word for it – “kiasu” or afraid to lose. This kiasu-ism has informed my habit of opening credit cards for sign-up bonuses for 30 years. I have even done this simultaneously in two countries – the United States and Canada – for the past 13 years. I played a lucrative game, always by the rules, which have gotten trickier over the years. For example, in the US, Chase Bank imposes the infamous unofficial “5-24 rule” which effectively says that your credit card application will be denied if you’ve opened more than five accounts with any bank issuer in the past 24 months. There are card-specific restrictions too, such as not having received a sign-up bonus in the past 24 months for airline affiliate cards.

I always make sure I read the fine print when applying for a new card product, and the one time that I didn’t give it close enough attention, it cost me dearly.

The Context

But let’s back up for context. I have dual citizenship in the US and Canada. Yes, this has significant disadvantages mostly from the US end, such as being taxed on my income by the IRS regardless of where I live in the world. However, I enjoy the perk of having access to US credit card products with their highly lucrative sign-up bonuses, which I have collected to fuel aspirational travel.

I collect my points in airline programs as well as more flexible currency such as points through American Express Membership Rewards and Chase Ultimate Rewards. One of my favourite programs is British Airways, an airline I hardly fly but whose currency I value for excellent redemption rates on short-haul travel. For example, in the old days (before devaluations) I have flown from Taipei to Hong Kong in economy for 4,000 miles and Hong Kong to Bangkok in Business Class for 12,750 points, both on Cathay Pacific.

On the other hand, long-haul travel generally costs substantially more with Avios than other mileage currencies with some key exceptions. In particular, Avios is also the currency of Qatar Airways, which has QSuites, one of the best business class products in the world. Linking my Qatar Privilege Club and BA Executive Club accounts, I was recently able to redeem a flight from Los Angeles to Doha in QSuites and onward to the Maldives for 85,000 Qatar Privilege Club points.

Another reason I love the Avios program is that British Airways Avios points are easy to earn and very flexible. In addition to earning BA Avios through its own credit card products in the US and Canada, BA is a transfer partner of Chase, Capital One and American Express in the US, and in Canada it is a transfer partner of American Express and RBC’s Avion program. In the US, I have taken advantage of transfer bonuses as high as 40%. In Canada, the transfer bonuses aren’t as lucrative in absolute terms, but I especially value earning BA Avios through my Canadian cards at a 1:1 ratio given the weakness of the Canadian dollar and the fact that the same base transfer ratio applies in the US on Amex spend. Occasional transfer bonuses in Canada as high as 30% (through RBC’s Avion Program) just make the deal sweeter. Finally, Avios points are flexible as they are transferrable between BA’s Executive Club and the airline programs that have adopted the Avios currency. These are currently Aer Lingus, Iberia, and Qatar Airways.

The Mistake

It was 2019 and having taken advantage of sign-up bonuses in two countries for years, I was feeling pretty complacent. I was under the 5-24 limit in the US and decided to reapply for the British Airway Visa Signature Card from Chase Bank. I was easily approved for it and hit the spending limit of $3,000 within a couple of weeks purchasing new tests for my psychology practice. The sign-up bonus was 50,000 Avios points and I was expecting to see these reflected in my next billing statement. I’ve done this numerous times. What could go wrong?

Well, the 50,000 points didn’t show up on the statement, but still I didn’t stress too much about it, presuming it was glitch on the end of Chase that would be sorted out in time. When the points didn’t show up again on the following statement, I called in to Chase and was told by the rep there was no reason why the points wouldn’t post as it seemed straightforward. The rep asked me to wait one more billing cycle and if the points didn’t post by then, to call back and someone would help me by getting the points posted manually.

Armed with this reassurance, I wasn’t too stressed when the points didn’t post by the third billing cycle. I called in, explained the situation to the rep who took my call, and was put on hold. The hold time dragged on and on and I started to get a sinking feeling in my gut. When the rep came back to the line after what felt like an eternity, she dropped the bad news that my points didn’t post as I had violated a condition on their disclosure that I had never heard of, but would have known about if I had read the disclosure closely. Now, by this time I thought I knew the game and had stopped reading the T&C closely, focusing rather on the 5-24 rule and making sure the other major condition of getting the sign-up bonus was met, namely that it was at least 24 months since receiving a sign-up bonus on the same card.

The Surprising Rule I Violated

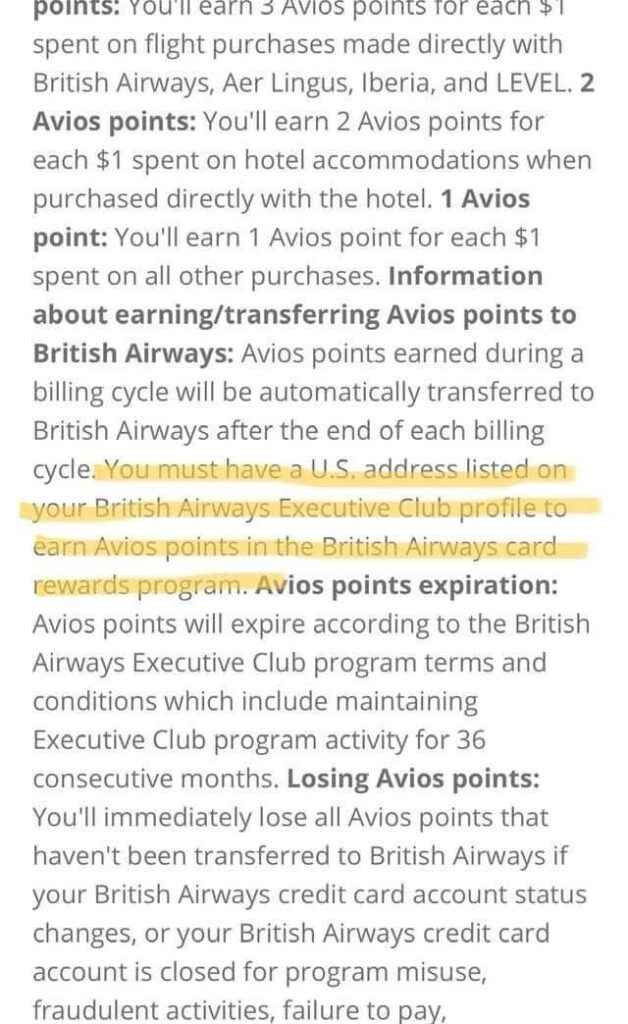

The rule I violated was not having my US address but my Canadian one listed on my British Airways Executive Club account. I had a vague recollection of switching my address over to Canada at one point. “I live in Canada,” I thought at the time, “so it would be a good idea to list my Canadian address.” Well, it turns out that this arbitrary choice on my part cost me fairly dearly in terms of the missed sign-up bonus.

Appealing to Chase

Now I’m pretty good at arguing myself out of pickles, and I usually get what I want using a combination of charm and persuasion. (I have even talked my way out $5,000 fines twice for not having done my pre-arrival registration on ArriveCAN during Covid.) However, my appeal to Chase went nowhere because rules are rules, and it was my fault. The supervisor I spoke to stuck to his guns and would not bend despite my appeal for some flexibility based on the fact of this being an honest and minor oversight and my excellent history as a Chase customer. I lost, and the worst part of it was not being able to reapply for the card for another two years and wasting part of the 5-24 quota on this application.

The Take-Aways

At the time, the Singaporean in me just hated the feeling of losing out. It took a couple of days before I gained some perspective and realized this is a first world problem and there are way more important things in life to care about. I’m pretty neurotic but my saving grace is I can laugh at myself (I think this is why comedies with neurotic people like Seinfeld are such big hits – it’s no fun being neurotic, but it’s entirely relatable to most of us and helps us to laugh at our own shallow self-absorption).

On the less philosophical and more pragmatic side, if you collect Avios points and have addresses in the US and other countries, make sure that your Executive Club account lists your American address in order to collect Avios points, including the sign-up bonus, from spend on the Chase British Airways Visa Signature Card. If you hold the BA credit card in Canada (issued by Royal Bank), there is no similar clause so your points should still credit if your address is listed in the US.

Finally, if the point is not already abundantly clear, you should always read the fine print to avoid the pain of losing out on valuable points. While perspective is nice, perspective with 50,000 Avios points would have been even nicer.